Clearly, H121 has been phenomenal and we are sitting on unlevered 23% net return for the first six months. So naturally, we should throw out a few names where the opportunity now lies behind us and that we no longer consider worth covering - unless you do, that is.

New Names:

Please see our unchanged analysis of Adient here.

The Adient trade has played out very well for us, but aside from a

Please find our unchanged analysis on Adient here.

The latest results clearly show the company’s turnaround is on track. We see the SSNs, in which

We are rotating out of a number of names that have either fulfilled their investment thesis or have failed to do so or have otherwise traded up significantly post March and therefore hold more beta than alpha now:

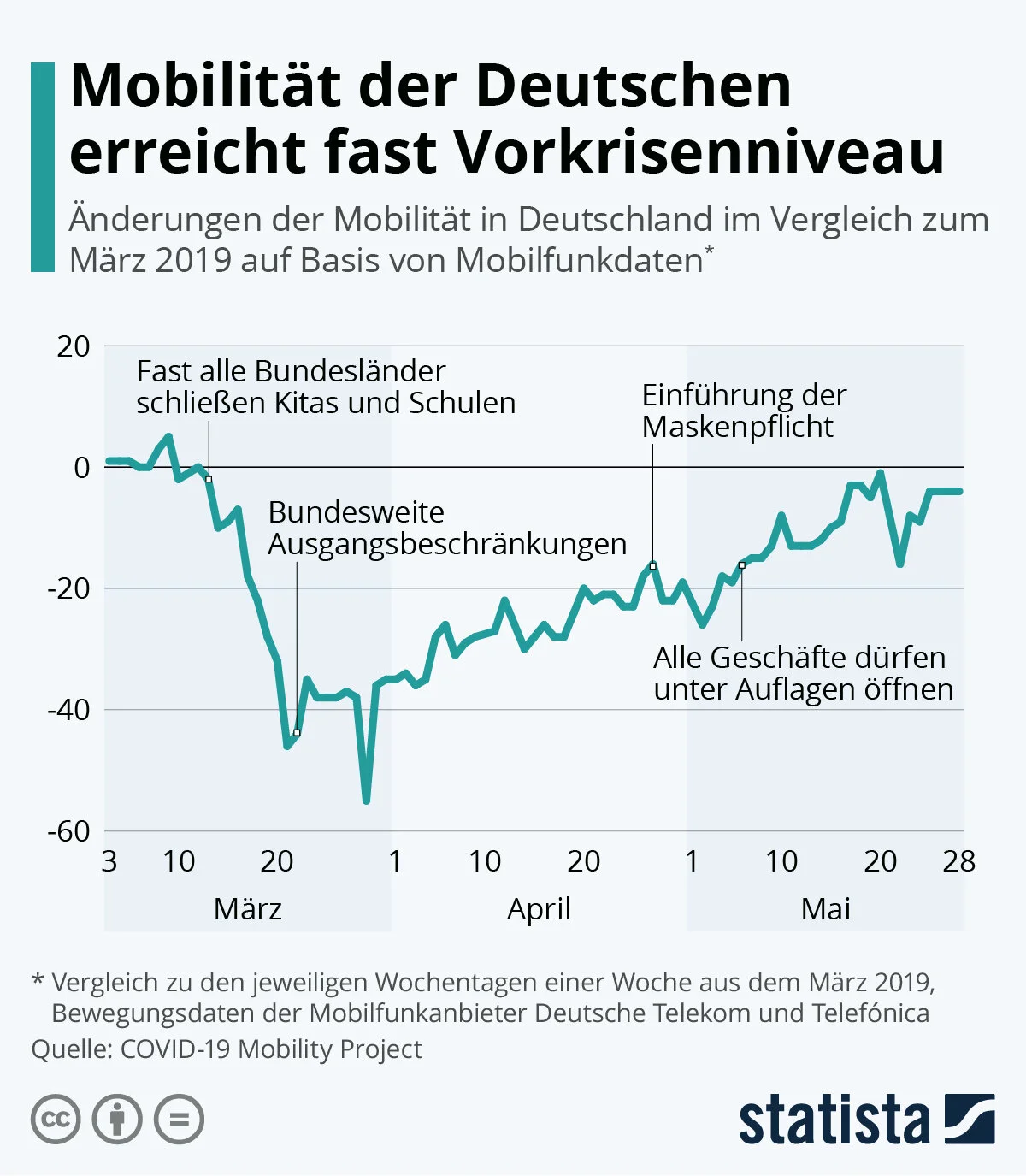

We are definitively working on more short ideas, but here goes a different view. Below is my entry for graph of the month.

The market has traded up

Adient management made several important observations on the call this week:

1) Especially since raising the additional 600m last month, the company has

Please refer to our analysis of Adient here (Antolin to come) and to previous comments on volume expectations, China volumes and rebound to date by OEM segments.

Please refer to our updated analysis of Adient here.

With $1.6bn at the end of March Adient’s cash on balance sheet position is E300m better than we had expected, which is presumably due drawing the remaining E175m of European RCF and $125m US FILO.

Conclusion:

Please find our stress tested analysis on Adient here.

The company today announced that its CFO has fully drawn the US line of

Below is an account of each of the names we follow and have begun work on in the context of Covid19 and Oil prices. Several names stand out as having become either uninvestible or outright attractive - already now.

Following Adient’s strong Q1 results, please find our updated analysis here.

The company has announced two catalysts for the year:

Please find a slightly updated analysis of Adient here.

Good liquidity, since bond issue last year, but NCF to remain flat to negative in 2020.

Adient have been wobbling quite a bit in recent days.

The auto sector is generally under pressure from

Two random themes from Germany this morning: Car Industry Investments and Consumer Rates.

1) Car Industry Investments:

The German car industry could be shedding some 10% of