The bullish view

All,

We are definitively working on more short ideas, but here goes a different view. Below is my entry for graph of the month.

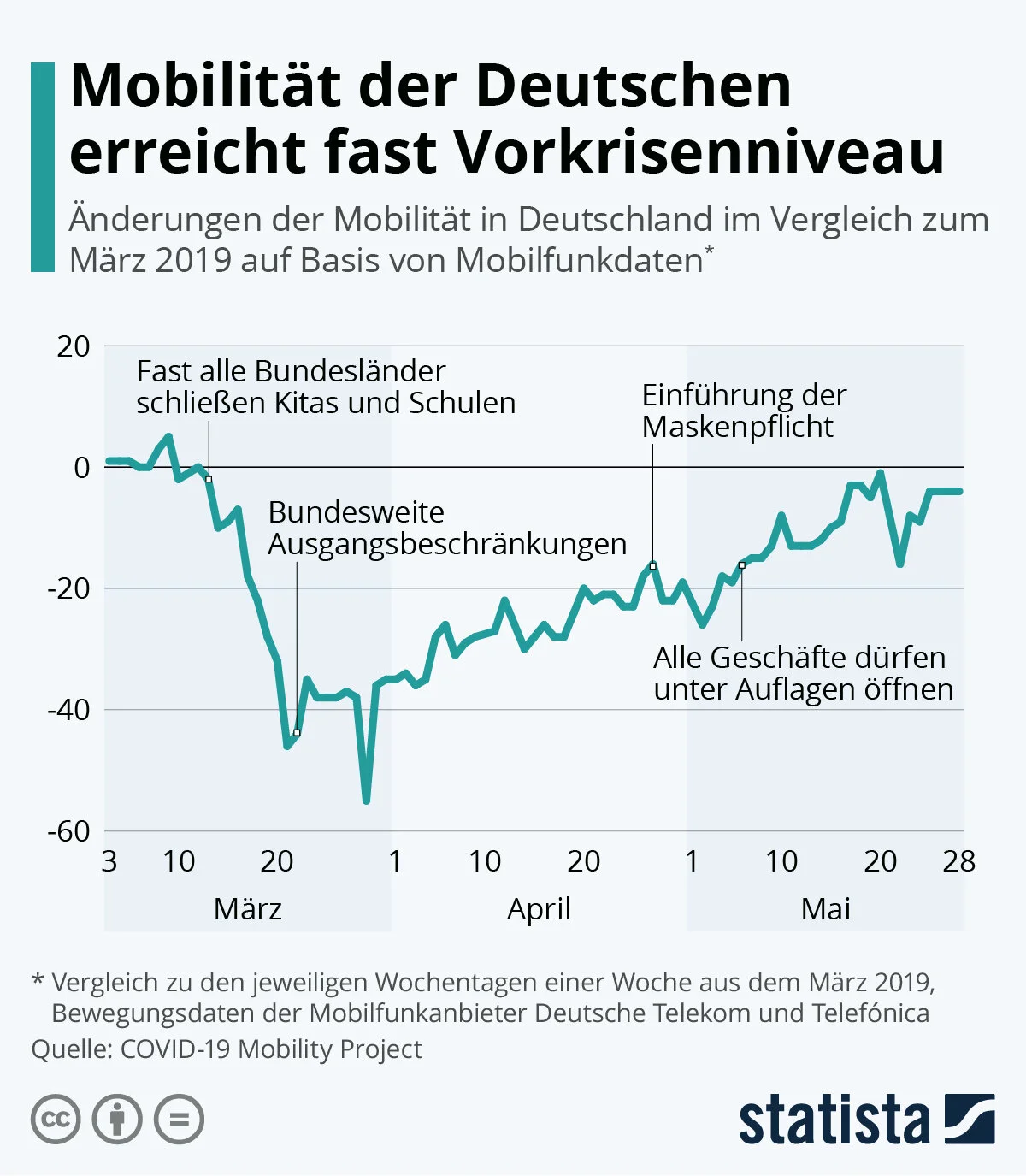

The market has traded up significantly and yes, Germany may have fared comparatively well but the implication is all the same. Except for a few impacted sectors, we’ll end up losing only some 2% or so (run rate) - noting the world won’t make up for in a year.A bullish view:None of the following is really new, but: To the extent the below recovery shape can be transposed onto other countries including the UK for instance (seems to be a little deeper and not quite as quick on the bounce, but similar in the scheme of things), the RAC and the AA may see less of a longer-term effect than many fear. Cars and car supplies, having been out of production for some time, will be in demand again - particularly if some of the reduced mobility shown here is attributable to public transport (I’ve had two conversations with people looking to buy a car in the last 24h). Energy consumption should eat Into inventory levels more quickly than feared. Clothes will be worn for the same purposes and with the same quantity again. Some business air travel will be lost, but if the local competitor has a face to face sales meeting with your prospective, are you really going to rely on video? No. You fly. Clearly there are obvious sectors that will be materially impaired, or at least face significant uncertainty. Also job-less claims do not bode well for consumption. And all the while markets have recovered from their lows to a large extent. But aggregate activity returning as rapidly as this puts it all in perspective. Wolfgang