On topline revenue, SGL Carbon experienced growth across all its business segments, notably in the automotive and semiconductor segments and despite the conflict in Ukraine, SGL Carbon remains

Please find our unchanged analysis here.

The recovery in volumes and profitability that we had modelled was eventually evident in the strong H221, which also marked our exit at the time. 2022 is going to be tougher due to

Please find our unchanged analysis here.

In the first 9-months of 2021 SGL Carbon has experienced sustained top line growth accompanied by improving EBITDA. The pace of growth is slowing, and

Please refer to our unchanged analysis here.

Recovery in volumes and profitability is proving slower than we originally hoped but we do expect a stronger 2H21 with orders picking up as the year progresses. Our view remains that

Please find our unchanged analysis on SGL here.

The research grant should support SGL’s FCF going forward. As with most research grants, this will flow over time instead of

Please refer to our unchanged analysis here.

Following a “data correction” by Deutsche Boerse announced on Friday, SGL Carbon will return to the SDAX, Germany’s small-company index. This follows the

Please refer to our unchanged analysis here.

The chip shortage continues to make headlines today, with US President Biden working to review supply chains and to ensure that US automakers get

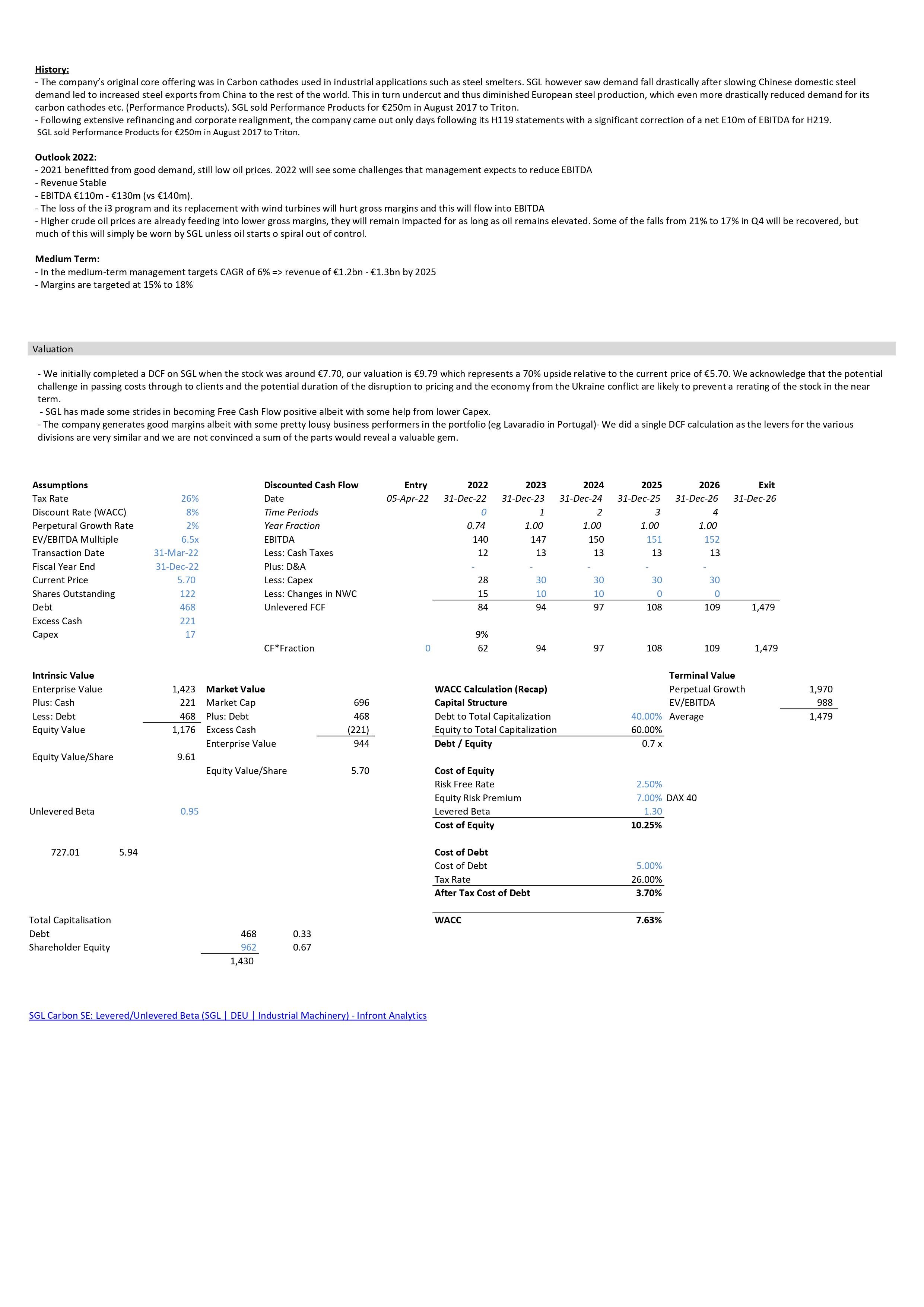

Please find our updated analysis here.

Following further analysis of the company’s cost structure we are taking

Please find our unchanged analysis on SGL here.

SGL’s Q3 20 results were stronger than expected. Revenues were roughly in line with our projections, but EBITDA of EUR36m was significantly

Please find our unchanged analysis of SGL here.

The impairments and guidance downgrade do not come as a surprise, given the significant impact of the covid crisis on two

SGL’s reinstated guidance after the 1H 20 results suggests the business is finally regaining some degree of visibility. The preliminary assessment of the new CEO, as presented in the call, appears both

SGL Carbon were weak as expected.

The five-year plan presented earlier this year would not have produced sufficient CF to pay for the necessary CapEx even before the pandemic.

Key takeaways:

Below is an account of each of the names we follow and have begun work on in the context of Covid19 and Oil prices. Several names stand out as having become either uninvestible or outright attractive - already now.

Please find our updated analysis of SGL Carbon here.

Clearly the strong shareholders of the company are spoiling

Two random themes from Germany this morning: Car Industry Investments and Consumer Rates.

1) Car Industry Investments:

The German car industry could be shedding some 10% of

Below are some random graphs that caught our eyes this week:

1) To our dear American Friends for Thanks Giving: Thank you very much from Germany!

Please find our updated analysis on SGL Carbon here.

- We are not yet sure how / if to position ourselves. SGL’s significant exposure to the Automotive industry will make it subject to

As per analysis, SGL are seeing their CFM business deteriorate on Textile Fibres and Industrial Applications. Interestingly, the company points out that

As expected, SGL are seeing their CFM business deteriorate on Textile Fibres and Industrial Applications. Interestingly, the company

Please find our initiation on SGL Carbon here.

The company is not headed for immediate default, but is set to add significant leverage over the coming