LONG Idea - video

- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Capital and Legal Structure - 6 Feb 23

Description - 6 Feb 23

Three Main Risks - 6 Feb 23

Investment Discussion - 6 Feb 23

Please find our updated analysis on Rekeep here.

Rekeep successfully refinanced its bonds earlier this year, and with some market dislocation in early April, we took the opportunity to reinvest in the name. Rekeep had to offer

Please find our updated analysis on Rekeep after its FY24 results here.

The recent market dislocation has led to the bonds falling 5pts, yielding 10.6%, and it is worth a revisit. Rekeep is not impacted by tariffs and is low beta to the market. There are no

Rekeep posted its Q4 and FY24 numbers on Friday, most of which were released as part of the refinancing in February. Takeaways from the call include

Rekeep will redeem its existing notes today, February 21st. This exits our successful long position in these bonds, initiated in

Rekeep has successfully raised €360m 2029 bonds at 9%, with the use of proceeds to take out the existing 7.25% bonds. We had said that there would be a

Rekeep’s investor call for the launch of a new €350m 4.5yr, 9.5% at 97.5% (c.10.3% yield) has only just ended. Proceeds plus cash on the balance sheet shall be

Please find our model post the release of Q3 numbers here.

Rekeep’s Q3 numbers are broadly in line with the initial focus on the partial drawing (€15m) of the RCF taking the headlines. Q3 always sees a

Rekeep published their Q3 numbers broadly in line with our model. Q3 is always tough regarding cash flow with a large

Following the Q2 conference call, management stated they were looking at options to refinance the bonds, including the sale of assets or disposals

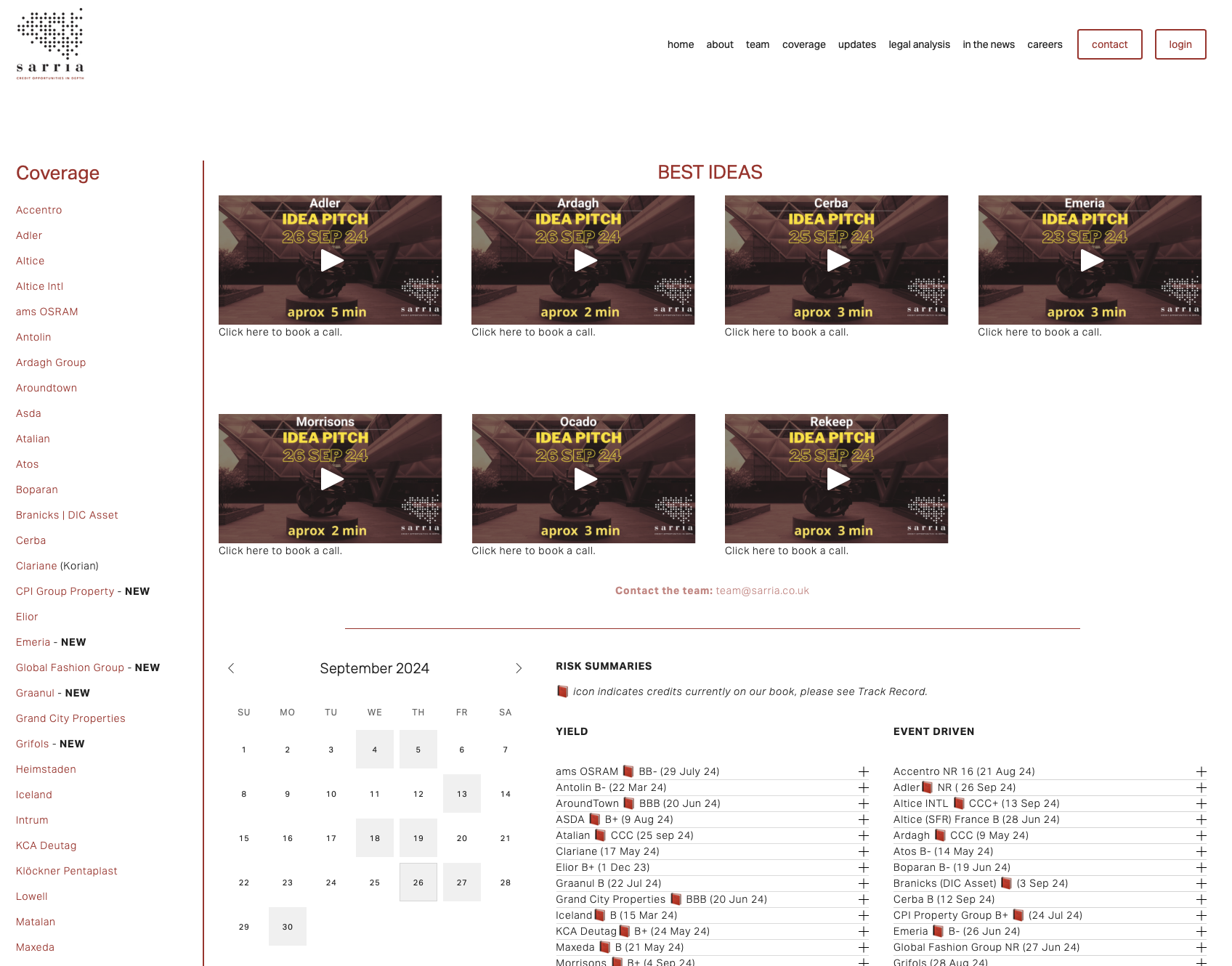

We are excited to introduce a new feature to more readily deliver to you our top ideas at any time. We are not YouTubers, but we are now recording our ideas in short 2-5 minute videos, which you can find on our website right on top of the landing page.

Please find our updated model here.

This is a short update but we have made an interesting observation on the growth rates in Italy and Poland derived from the Net Operating Working Capital data provided by the

Ignoring tax credits (which were related to the energy crisis in FY22/23) this is the highest LTM EBITDA in the last 10 years. Revenue continues to grow, mainly due to

Moody’s changed the outlook to negative for Rekeep’s bonds citing the same issues we have previously written about - the poor cash conversion and upcoming

S&P reaffirmed Rekeep’s rating at B, but kept its outlook on Negative. The reasons quoted by the S&P analyst echos comments we have made in the past; a slightly improving

The Company continues to manage its liquidity and significant working capital as it aims to deleverage before a refinancing. Management again mentioned the potential for asset sale to aid debt reduction. Rekeep has rearranged

Please find our updated analysis here.

Rekeep continues to bobble along, but as time ticks closer to the maturity of their bond in February 2025, the lack of cash deleveraging will hamper its

Best to ignore the headlines which compare FY23 and Q4 23 versus prior year as these are distorted by the tax credits received last year to compensate for

A group of shareholders, 11.3%, have filed with the Court in Bologna seeking an appointment of an independent judicial director and removal of the

Please find our updated model here.

Rekeep bonds have traded down 3pts on the back of their Q3 numbers. Although the Company had guided to weaker revenue (on the back of falling energy costs,

Rekeep reported a weak set of numbers yesterday. Although the Company had guided to weaker revenue (on the back of falling energy costs, reducing the

Please find our updated Rekeep model here.

Post the Q2 numbers, Rekeep bonds have traded down, widening by 100-150bps as investors show some concerns regarding tender levels, working capital movement, loss of Saudi contract and the level of debt associated with factoring facilities.

Rekeep posted their Q2 numbers yesterday which, adjusting for the tax credits, showed a modest decline in top line, albeit with improving EBITDA due to

Please find our unchanged analysis here.

A short note following up on our exchange with Rekeep management. Details are below but briefly, Rekeep will draw in full the new Reverse Factoring facility

Please find our updated model here.

We are trying to rearrange a call with Rekeep management, but in the meantime, we have updated our model for Q1 numbers. There is no change to our model from our previous and we remain comfortable with our 3% long position in the Rekeep Senior Secured Notes.

Please find our updated model here.

We are awaiting Rekeep’s Audited Consolidated FY22 numbers, but in the meantime, we have updated our model. There is no change to the model since our

Please find our analysis on Rekeep here.

We are taking a 3% long position in the Senior Secured Notes. Ultimately, at current levels of 86% (13.5% YTM), we believe investors are being compensated for the risks posed by this name. In principle, Rekeep is an extremely stable business with a

This story has played out a while back and bonds are call constraints. This makes them wonderfully steady in a sell-off, but

Please refer to our unchanged analysis here.

The announcement at the weekend of Rekeep acquiring a 60% stake in a €10m annual revenue business has prompted us to re-examine our long position in the bonds. The acquisition, which the price is not disclosed, is

Please refer to our unchanged analysis here.

The new bond issue confirms our positive view on Rekeep. In the current market context,

Please refer to our unchanged analysis here.

The news on the Santobono legal case is better than expected. The revenues impact from a 6-months tendering ban is