Please find our unchanged analysis here.

KME (Aengus) – Having completed the purchase of flat-rolled products from Aurubis. KME continues to accumulate copper assets. Does KME see a shift in business focus facilitating it's staying in the game? KME has €110m of bonds and a fully drawn €320m borrowing base facility to refinance in the next 6 months, how will it get leverage over bondholders to roll their exposure or additional security to offer the banks? We look at the changing nature of the business and the balance sheet moves for evidence that the risk is moving. However, as there is only a stub of bonds left outstanding, the ability to participate in the name is very limited for now.

We noted on the Q122 conference call that KME management expects to announce in Q3 how it is going to refinance the outstanding €110m SSNs (maturing in February 23). We are

We agree with much of what Fitch had to say about KME in its ratings change for the SSNs. Whilst the repayment of €190m of the €300m bond was positive for bondholders, there are still liquidity risks. The remaining €110m bond matures in February 2023 and the

Please find our unchanged analysis here.

The decision to use asset sale proceeds to tender for bonds rather than buy copper had us puzzled, but the money has been committed, so we look forward. Copper

For over two years we have been told about a possible line of credit from the Italian export credit agency (SACE) to support KME. It has finally

The completion of the sale of the Wires business, announced in November 2018, sees more liquidity coming into KME. The company continues to

Please find our updated analysis here.

KME’s decision regarding the use of proceeds from the sale of the Specials business is at odds with a business looking to rebuild volumes in its copper business. With insufficient

Please find our slightly amended analysis here.

Since the completion of the sale of 55% of the Specials business, Bondholders have been hoping for much of the cash to come their way. KME's banks have now

KME’s decision to move some production from France to Italy and lay off 117 workers reflects the constraints on volumes at the KME group as well as

Intek announced the completion of the 55% sale of KME’s specials business to Paragon. The release commented that the proceeds would

The reshuffling of assets and refocusing of the KME business continues. The €20m of proceeds from the sale and

Please find our updated model and analysis here.

Investors have decided that the proceeds of KME’s sale of part of its Special’s business are coming their way. We are

Please find our unchanged analysis here.

Conclusion:

KME’s method of acquiring a rolled copper products business co-located at its Brescia plant demonstrates on the one hand its constrained

Please refer to our unchanged analysis here.

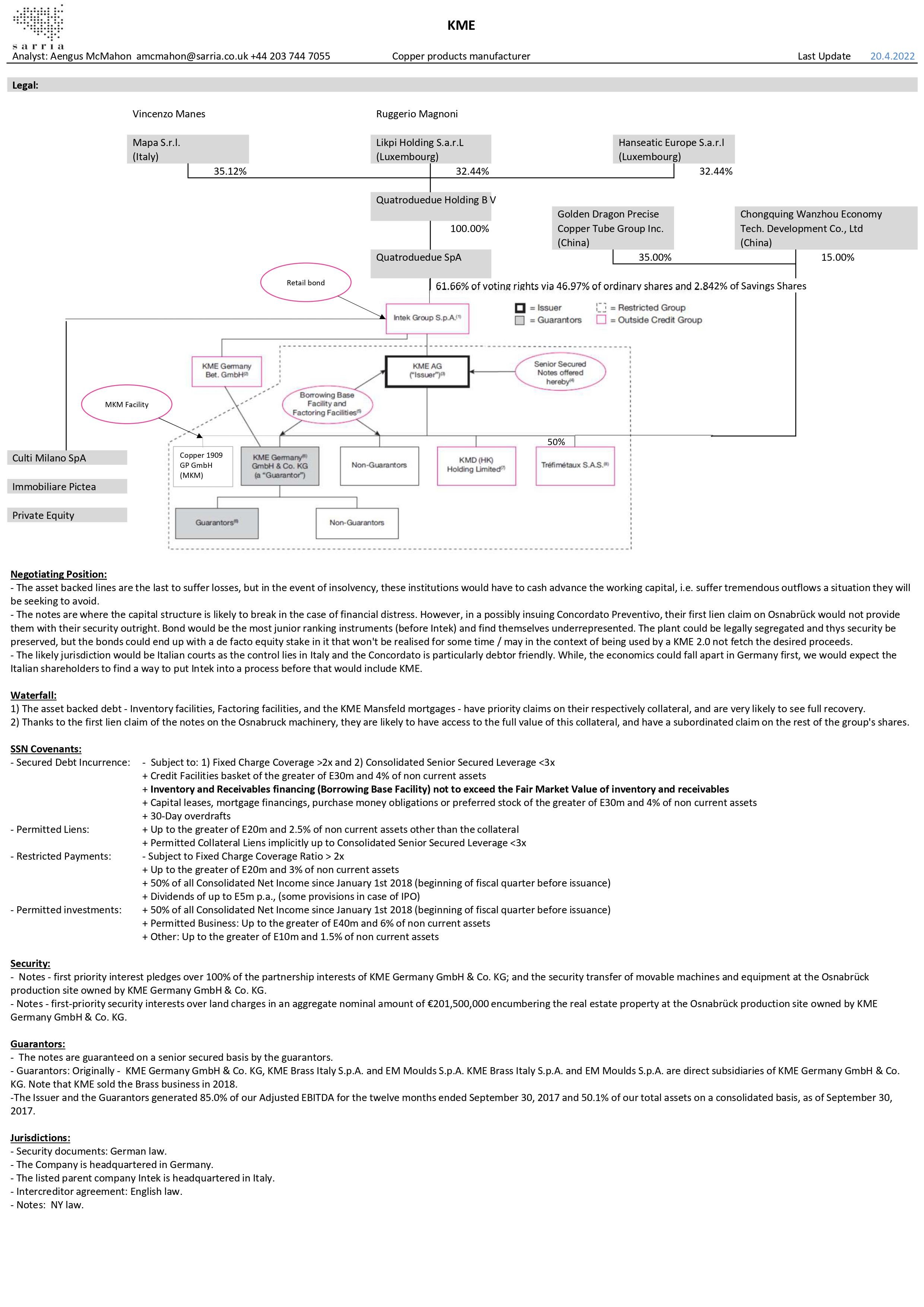

KME’s pressing issue is not the bond’s maturity, and so it is not the bonds that will be addressed with the sale of the Specials division. We do not anticipate a

Please refer to our unchanged analysis here.

Renewed efforts by certain lenders to sell their exposure in the borrowing base facility suggests that any financing solution is

Please find our updated analysis on KME here.

While the company this week reported results substantially in line with model, it failed to report any news on its financing, or working capital arrangements. The copper

Please refer to our unchanged analysis here.

The financials released this morning reveal a significant decline in activity over Q420 - even if factoring in the

Please find our reworked, analysis on KME here.

With the copper price surging, our analysis of company liquidity is focused on trying to understand the moving parts in KME’sworking capital. In our view

lease find our unchanged analysis here.

KME announced overnight the one-year extension of the EUR395m inventory-backed facility, and the EUR150m Factofrance factoring facility. The

Please find our unchanged recent analysis on KME here.

Heightened speculation around a potential disposal of parts of the Special products division, triggered by a Reorg article, has led to a further appreciation of the KME bonds.

This supports our thesis that

Please find our updated Q3 20 analysis on KME here.

The recent extension of the EUR300m KME factoring facilities and the EUR150m KME Mansfeld receivables facilities to Feb 23 from Feb 21 provides further comfort on the

Please find our updated analysis on KME here.

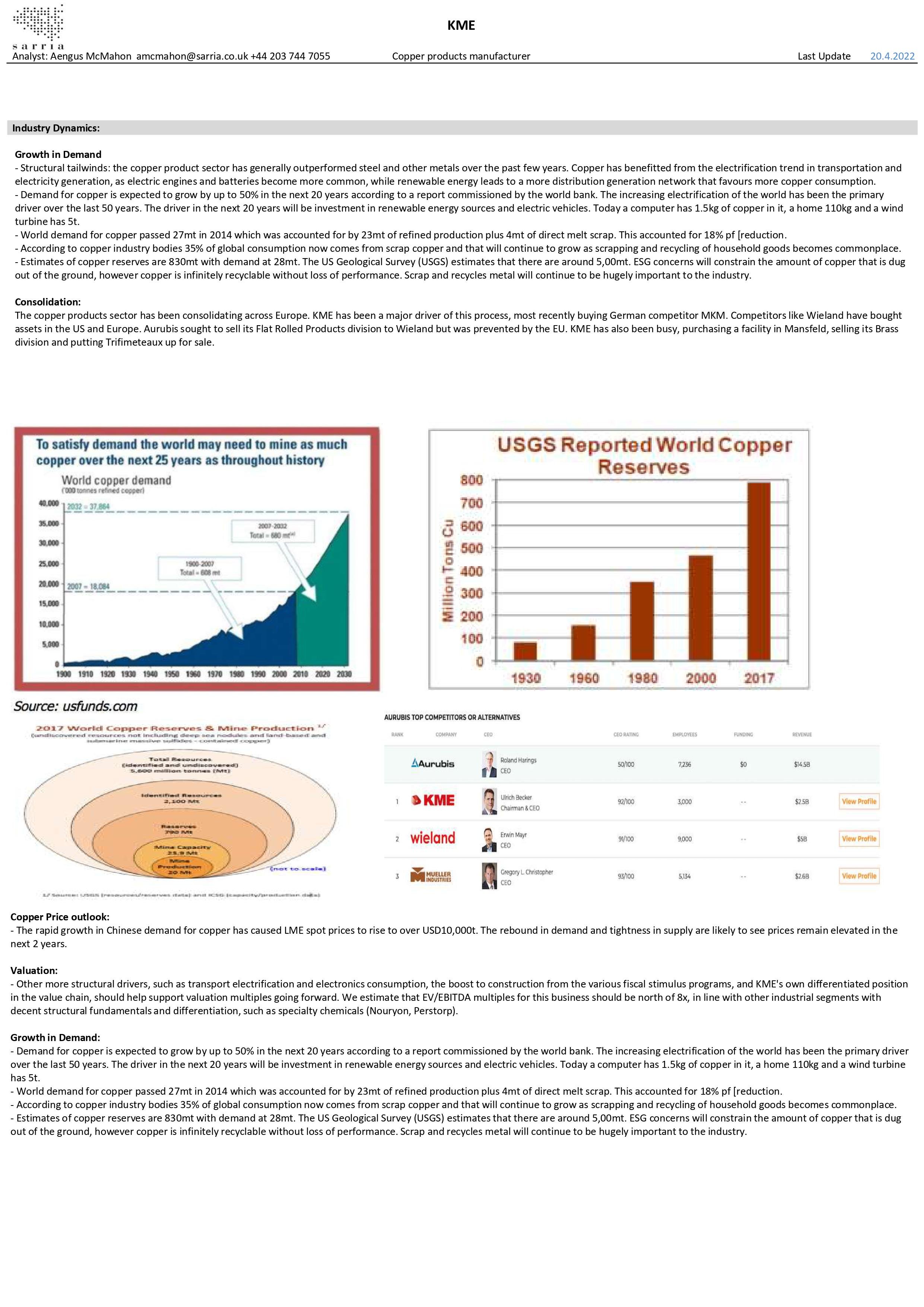

Manufacturing momentum: European Manufacturing PMIs remain strong even during the second wave of lockdowns. KME is highly diversified among sectors and should remain well supported going forward, despite a

Please find our updated analysis on KME here.

Based on the trading levels during the lows of the pandemic, we would not expect the bonds to dip below

While the Q2 20 numbers reflect the continued resiliency of the company into the Q4 19 and Q1 20 pre coronavirus slowdown, the full impact of the coronavirus will

KME’s reported numbers may look decent at first sight, but the details on cash flows, working capital and inventory price variations

We are initiating on KME. Please find our files here.

KME remains an interesting credit story, as the combination of lack of sell-side coverage and quirky reporting material makes it difficult for new investors to understand the business