The last 15 months have seen an incredible rotation of risk and returns and many of the names that offered opportunities last year have done phenomenally well, either because the feared drop in revenues never occurred, or because

Please refer to our unchanged analysis here.

The company continues to perform very well and we may be shelving our coverage of CABB as a result.

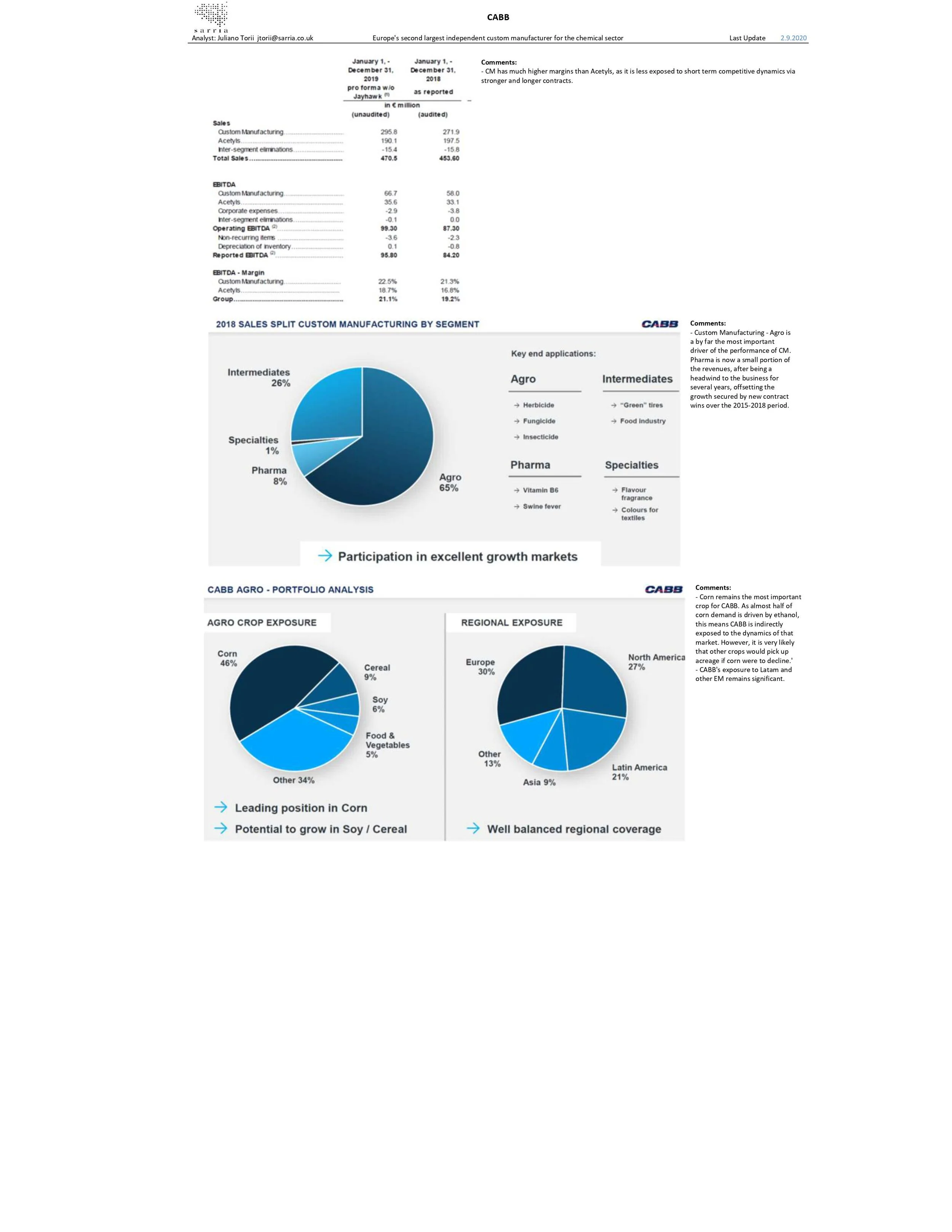

Top Line and Margins:

CABB remains very exposed to volume variations in the agrichem sector, especially for “off contract” products. The Bayer profit warning, which is

Please find our updated model here.

CABB’s Q2 20 results last week supports our view on the resilience of the underlying AgChem footprint. The new AgChem contract will lead to a meaningful increase in

CABB’s results were noisy as is often the case. The business remains resilient, and more so than what the reported figures would suggest, as the volumes in Custom Manufacturing were shifted into 2H 20, and especially

Please find our initiation of CABB here.

We are not considering a position in either the subordinated bonds or the senior bonds at this stage. While we acknowledge that